The primary distinction between an accountant and a bookkeeper is that the former is in charge of carrying out bookkeeping tasks within an organization where financial transactions are recorded methodically, whereas the latter is in charge of accounting for past financial transactions by an organization as well as disclosing financial affairs that demonstrate the organization’s precise financial position.

A bookkeeper is a person responsible for the data entry tasks. Some of the tasks included are:

- Entering bills from Vendors

- Payment of bills

- Preparation of Sales invoice

- Mailing of statements to customers

- Processing payroll data

An accountant will hold a professional degree in accounting and continue the operations performed by the bookkeeper. Some examples are:

- Adjusting entries to reflect expenses that the bookkeeper has not yet entered (e.g., Interest on bank loans since the last bank payment, wages earned by employees to be processed the following week)

- Preparing company financial statements such as Income statement, Balance Sheet, and Cash flow statement.

- They also help the management understand the financial effects of the decisions it has made in the past and will make in the future.

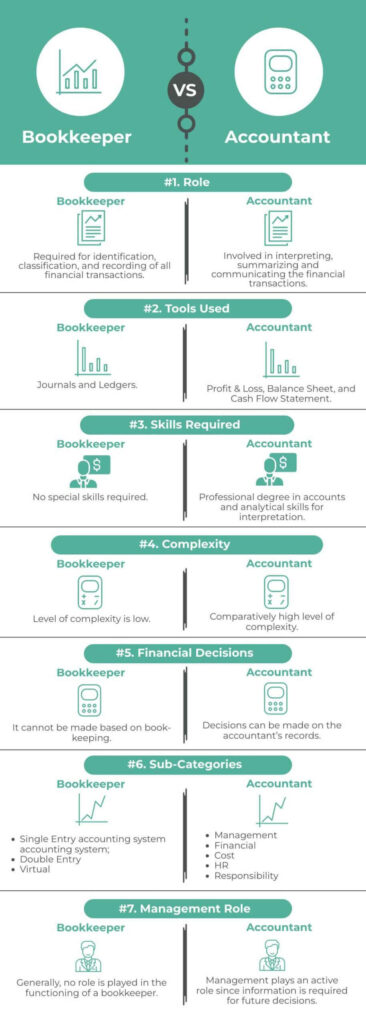

Let’s see the top 7 differences between Bookkeeper vs Accountant.

Key Differences

- Bookkeepers must recognize, measure, record, and ultimately categorize financial transactions. The most recent financial transactions recorded in the ledger account, on the other hand, must be summarized, interpreted, and communicated by accountants.

- Financial decisions cannot be made exclusively based on bookkeeping records but can be considered based on accountant records.

- Accountants are responsible for preparing financial statements and bookkeepers are not required to create them.

- Senior management generally does not get involved in the functioning of the bookkeepers. However, they would take an interest in the work of the Accountants as they require the information for making future management decisions.

- The tools used by bookkeepers are Journals and Ledgers, and that of accountants are the balance sheet, income statement, cash flow statement, etc.

Conclusion

The long-term profitability of every firm is strongly influenced by the bookkeeper’s ability to maintain accurate financial records, the accountant’s astute financial planning, and the bookkeeper’s ability to balance the books.

Some business owners handle their own financial management. Others, on the other hand, might decide to engage a specialist to concentrate on the areas of the business they are interested in. Either choice will aid in the expansion of their company. In addition, as technology advances, many software programs are updated to perform duties automatically. With time, this aspect’s definition and criteria will change, thus it’s important to stay current.